Even the best binary options trader should stick with the call and put options the majority of the time. They have lower rates of return, but they are much simpler to predict with accuracy, and the smaller rates add up to big profits over time, especially as you get better at what you are doing.

However, that doesn’t mean that there is no place in your trading repertoire for exotic trades. As a beginner, you probably tried some of these, realized how difficult they were to hit with any sort of accuracy, and then moved on to the easy money. As good of a lesson as this might have been, the exotics are worth revisiting. This is mostly true of the high yield one touch and boundary trades.

Understadning the One Touch Trade

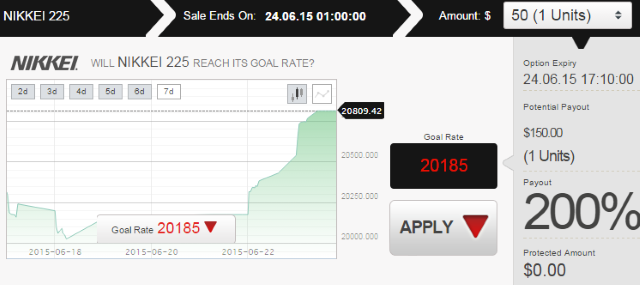

The one touch trade is just what it sounds like: you need to only hit a given price for a moment during the expiration period, and then your trade is a winner-regardless of what the price finishes at. These are a good idea when you know that an announcement is coming up that will have a big impact upon an asset’s price if things go the way that you think they will. For example, let’s say you are trading Apple’s stock, and you know that they have an announcement coming up about a new product. You have read many tech and industry specific reports that say that the device will be way better than the iPhone. Once the announcement is made, there’s a chance that the price will jump dramatically, and if the previously way out there price is hit, you will be looking at a huge return. Some brokers can have rates of 500 percent or even more, depending upon how difficult the trade is to get correct.

The Boundary Method

Boundary trades are the exotic counterpart to one touch trades. Here, you are given a range, and your goal is to guess whether or not the asset will finish inside or outside of that range. There are many similarities in when a boundary trade is right, and when a one touch trade is right. The difference is that boundary trades need to finish where you think they will. Just going outside of the range for a moment isn’t enough. Direction gives you some freedom, but usually, you will have a firm grasp on which way the asset is most likely to move. However, this is a safety feature of the boundary trade that compensates for the extra difficulty and the fact that they must finish precisely where you think they will. Again, these have huge rates of return when you go with the high yield choice, and that’s a good thing for you.

Doing it Right

In order to be successful with exotic trades, you need to understand probabilities specifically, and math in general. This is one reason why successful poker players do so well in the binary industry; they understand odds, and know how to successfully structure their risk in order to turn a consistent profit with a positive expected value.

You need to make sure that your chances of success are going to be high enough to allow you to overcome the difficulty. A 300 percent return, for example, requires you to be right more than one out of four times. It could be 1.1:4, and you would eventually turn a profit over a long enough timeframe and enough samples. This is the kind of mindset you need to have when plotting out your exotic use. Things like the Kelly Criterion can help you learn how to appropriately size your risk more effectively, too, although this may be moot depending upon how much customization your broker gives you on choosing the size of your own trades. Still, with a firm grasp on how to approach odds, statistics, and other related aspects of math, you will thrive with these if you use them at the right times. Having experience allows you to approximate those things more accurately.